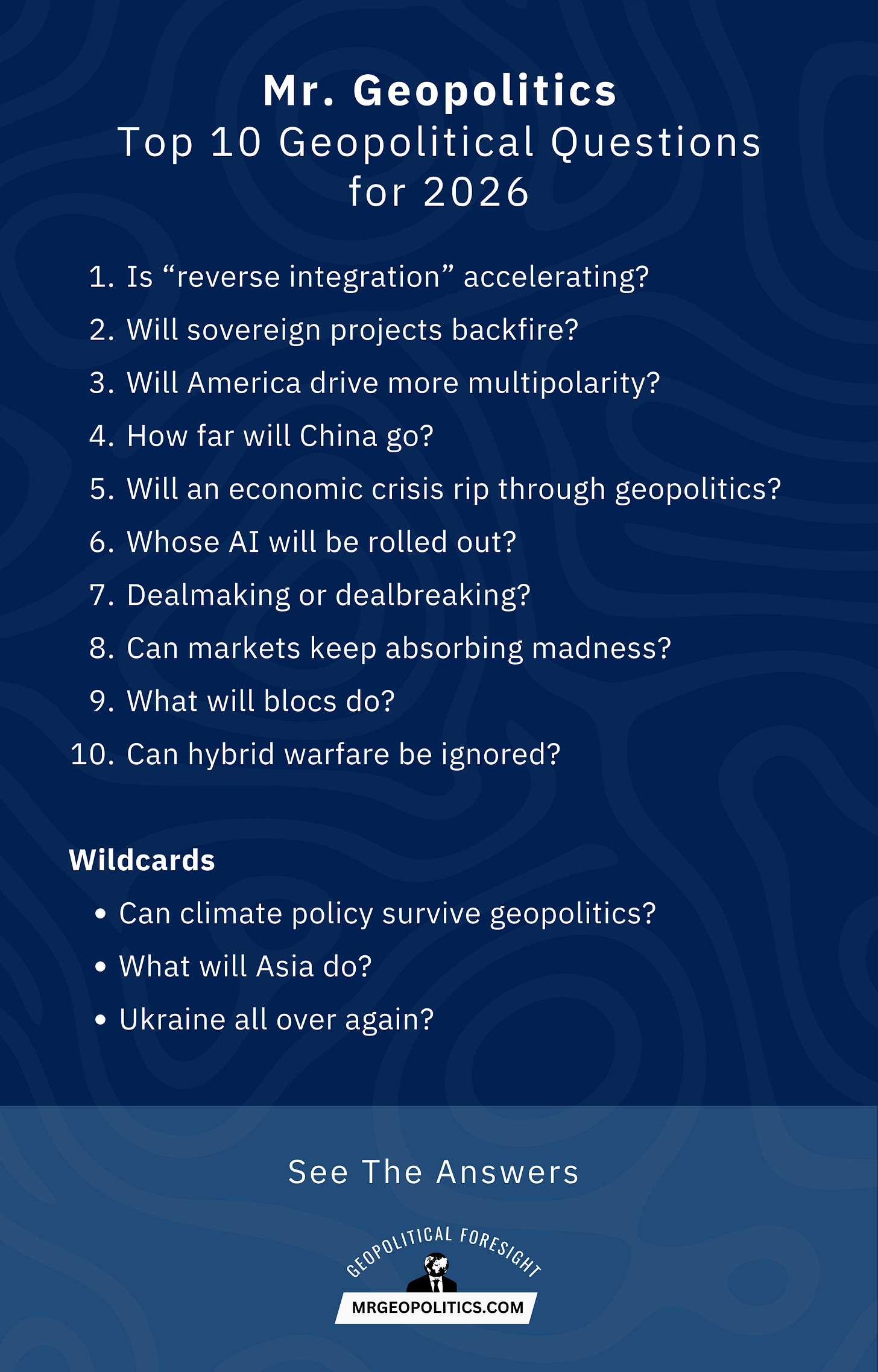

Top 10 Geopolitical Questions for 2026

The world is fracturing, and few are prepared

Some years need a disclaimer. 2025 was one of them.

America First. G20 reshuffled. West disunited. China emboldened. Wars, wars, and a sprinkle of AI. The five stages of grieving geopolitics - shock, denial, acceptance, negotiation, adaptation - swept through capitals and boardrooms like seasons of the year.

The result: a world more broken, bruised, and battered than at any point since World War II.

But 2025 was only a teaser.

In 2026, the global economy could be ripped apart as geopolitics forces governments to pick sides. Dealmaking could give way to dealbreaking. Regionalization may usurp globalization. For the first time in a century, multipolarity could steer the world.

The theme for the next 12-months: a fractured world. No other expression fully captures the rifts, chasms, and splits carving up the globe.

Below are the top 10 questions facing every leader in 2026. With disorder spreading, stakeholders must enter the new year armed with a single belief. Certainty and predictability are almost gone. Few know what will happen next. Everybody is now navigating an environment where nothing is as it seems, paradoxes are at every turn, and anything is possible.

Welcome to the fractured world. Welcome to the new jungle of geopolitics.

ANSWERED: Top 10 Geopolitical Questions for 2026 👇

#1: Is “reverse integration” accelerating?

In China, American chips are being phased out. In India, the government wants tech firms to pay for AI training data. In Europe, pressure is building to “Buy European” (not American). As geopolitics ticks up, economies are not integrating deeper. They are going in reverse. Forces like technology and strategies like trade redirection (i.e., China pushing goods to Europe and Southeast Asia) are pushing countries in opposite directions. In 2026, reverse integration1 could shift into a higher gear as governments rethink critical links, slowing the pulse of “old globalization.” As wars and rivalries intensify, everybody is hunting for economic security. In the process, the glue that kept economies in lockstep for decades is weakening.

#2: Will sovereign projects backfire?

The mantra of the 20th century was stability. The mantra of the 21st century is sovereignty. From economic to cultural to technological, governments are pursuing new borders and barriers. Except, in 2026, sovereign projects could run into walls. First, how “sovereign” can a nation truly be? The push towards AI sovereignty, for instance, hinges on foreign technology (i.e., American, Chinese). Second, sovereignty is facing off against pure geopolitics. The calls in Europe and Canada to buy local are on a collision course with America’s trade demands. The rush towards self-determination could have limits, as governments realize that absolute sovereignty is not possible.

#3: Will America drive more multipolarity?

The new US National Security Strategy, the first of its kind in generations, has a hidden story: America is ready to operate in a multipolar world. As Washington refocuses its attention on the Western Hemisphere, others will view Eurasia and Africa through a new lens. In 2026, America First could open the door to 21st-century multipolarity, escalating great power competition. Unlike in the past, the US may not seek to set the agenda for everybody, from AI to climate change. It may be okay with only leading ideologically aligned nations or redrawing specific regions. The big question is not only how America leads in a multipolar world, but also who other nations align themselves around.

#4: How far will China go?

A new China has formed, signaled by Beijing’s decision to weaponize rare earth exports, probe American companies, block Nexperia, and threaten export licenses, all in a span of months. This is not the China of the past, which bit its tongue to maintain global economic stability. This is the China of the present, which is ready to get bloody as its strategic patience runs thin. In 2026, the world must brace for China going beyond what it has done so far as flashpoints flare. Not only is the deal with America shaking, but friction is rising with Europe, Southeast Asia, and Africa. And, China’s partners, like Russia, Venezuela, and Iran, are preoccupied with their own geopolitics. China will not allow its national and global interests to be muddied. The era of “economic peacetime” is over. There are dozens of levers China could pull, squeezing the global economy and forcing many to wonder how far China is willing to go in a world where goal posts are constantly moving.

#5: Will an economic crisis rip through geopolitics?

Economic storm clouds are forming. In Germany, a trade group has warned that the German economy is in its worst crisis since the Second World War. In the US, consumer sentiment is at a record low. In India, net FDI has dropped almost 160% in certain months. With warning signs growing that a major recession (or depression) is around the corner, unlike in 2007-08, the next economic crisis will occur in a fractured world. A global economic crash is likely to have a jarring effect on geopolitics. Nations may redesign budgets, cut aid, or pull back from certain engagements altogether. However, the other side of the coin is equally dangerous. Those in a fragile economic state may become prey, as larger or stronger economies see opportunity - and salivate.

#6: Whose AI will be rolled out?

When the Covid-19 pandemic occurred, geopolitics and AI were separate forces. Today, they have fused into a meta force. At one moment, the US is refusing to give its most advanced chips to non-US companies. At another moment, Chinese AI models are matching Western models. But trade walls and R&D are only the first chapter. In 2026, the second chapter of this fusion begins, and it revolves around which AI the world will gravitate towards. The pressure is building on countries (and cities) to pick an AI corner. And, which corner they pick will signal their geopolitical alignment. Whether it is AI chips, data centers, or services, a new competition could soon commence as world powers compete to roll out their AI, and in the process, change the global balance of power.

“Geopolitics of AI” is an expression used across the world today. But did you know, it was coined by Abishur Prakash in 2016, as part of his Next Geopolitics book series, and later as the title of his 2018 title, “Go.AI (Geopolitics of Artificial Intelligence)”?

#7: Dealmaking or dealbreaking?

Agreements used to last decades. Today, they might not last a year. A ceasefire between Cambodia and Thailand, inked in July 2025, broke down in November. A geoeconomic deal signed by the US and Malaysia in October 2025 started to wobble in a matter of weeks. The world is caught between dealmaking and dealbreaking, a new reality. In 2026, this tug-of-war will spread, forcing governments to pick one or the other. This is no easy decision. Sticking with a deal might reinforce relationships, but with the world in flux, it forces nations to stick to a potentially losing position. Sacrificing a deal might protect a nation, but it makes it unreliable and untrustworthy. Flip a coin or consult the stars, just do not turn to the past for wisdom. As dealmaking and dealbreaking wrestle for superiority, long-term guarantees are gone. The direction a country is moving in on Monday might be completely different by Friday. Agreements are no longer carved in stone. They are forever open to negotiation.

#8: Can markets keep absorbing madness?

The 12-day Israel-Iran war? Markets shrugged. A violent exchange between India and Pakistan, nuclear-armed states? Barely registered in the West. The US and China returning to fighting? Investors remained bullish, thanks to the AI craze. A clear disconnect has formed between geopolitics and markets, in tandem with the disconnect between bond markets and stock markets. In 2026, the markets-geopolitics nexus will reach a critical juncture. Either the disconnect will widen (markets keep absorbing geopolitics). Or, the chasm will begin to close (markets slide as investors panic about a global event). Markets have begun to dance to their own rhythm. Variables that once tamed markets, like jobs data, political turbulence, or bond stress, are having little bearing. This does not make markets immune. Instead, it raises the probability that eventually, something, somewhere, will tip the scales. The smart money is on geopolitics.

#9: What will blocs do?

It all started with BRICS. Fast forward a few decades, and blocs are back with a vengeance. The latest addition: a group in South Asia made up of Pakistan, China, and Bangladesh that seeks to edge out India. Yet so far, blocs have revolved around assembly (i.e., gaining members, defining their raison d’etre). But in 2026, blocs could begin to make decisions that change how the world works. Their decisions could be at odds with the old guard or a bulk of the global community. The focus was once on what blocs would form or who would join them. Now, however, from Eurasia to Africa to the Americas, it is on what blocs will do as they attempt to mold geographies in their image.

#10: Can hybrid warfare be ignored?

The plane carrying EU president Ursula von der Leyen being jammed, and the largest mall in Warsaw being set on fire, have the same handprints and point to the same reality. Hybrid warfare is escalating, driven by industrial sabotage, mysterious cyber attacks, state-backed groups, and more. This is no longer just about drones buzzing a NATO base or a European airport. It is about economic assets, social stability, and critical infrastructure being permanently destabilized by adversaries. In 2026, the probability rises that hybrid warfare may cross the “red line” of a country. At a moment when Europe discusses joint-cyber attacks against Russia and Japan-China tensions explode, the world is “primed” for a new explosion. The next incident of hybrid warfare could coincide with the next geopolitical clash, as governments refuse to hit the brakes.

Wildcards:

Can climate policy survive geopolitics? Progress on solving climate change has effectively stalled. The last court of hope, the annual COP Summits, has seen little achieved as global powers refuse to commit. Adding to this, the US reversal on clean energy, doubling down on coal, and pushing wind projects to the side, has only made climate talk even more divisive. Solving climate change is being held hostage by geopolitics. Without rescue, 2026 may be the year when global climate solutions are usurped by nations (and blocs) pursuing independent paths. And these paths do not guarantee a green transition.

What will Asia do? The era when Asia adapted to the decisions of others is ending. The era when the world adapts to Asia’s decisions is beginning. With flashpoints ripe (i.e., India-Pakistan, North Korea-South Korea, China-Philippines), Asia is now the most “geopolitically dense”2 region in the world. In 2026, what Asian economies do will cascade across the globe. The next decisions will pressure many to put Asia first. Succeeding in Asia will mean redesigning strategies and reallocating resources for everywhere else.

Ukraine all over again? Germany is calling all men aged over 18 for medical exams, France is eyeing a new conscription drive, Poland is laying mines on its eastern border, and “citizen armies” backed by the state are forming across the Baltic. The message is clear: Europe is preparing for war with Russia. The post-Cold War peace is over. The end of the conflict in Ukraine does not guarantee rapprochement or stability. In fact, it could shift the battlefield elsewhere in Europe. The clock is ticking on an unthinkable showdown between NATO and Russia that could ignite in 2026. Unlike in 2022, when Russia invaded Ukraine, and few were ready, both the West and Russia are walking into the next war ready and clear-eyed. Coexistence no longer seems possible.

Conclusion

When it rains, it pours. When fires rage, they burn.

Geopolitics is the rain and fire. It is striking the globe from all angles. No relationship or industry is safe. Shelter is not possible. In 2026, governments and businesses must clear the table and shelve the old advice.

Political risk? Too narrow a lens for today’s world. Reglobalization? It only clarifies what is happening, not what is forming. Resilience? This is the salt to food, the basics.

Success in 2026 and beyond requires a “geopolitical reset”3 of paradigms, strategies, outlooks, and resources. That is what the new jungle demands. That is the only way to operate in the fractured world.

But, a word of caution.

The geopolitical reset is no simple feat.

Replacing human resources is easy. Ideating new strategies just takes time. At the level of geopolitics, there is no budget, only needs and blank cheques. The hard part is acclimating. What bet to make, what direction to move in, who to rely on (or break from).

None of this can be solved without clarity and foresight.

Governments and businesses are now in a race against time to replace their lens and outlook. Or else, when the calendar rolls over into 2027, the battle may already be lost, as the wilderness devours the ill-prepared.

—Abishur Prakash aka “Mr. Geopolitics”

Mr. Geopolitics is the property of Abishur Prakash/The Geopolitical Business, Inc., and is protected under Canadian Copyright Law. This includes, but is not limited to: ideas, perspectives, expressions, concepts, etc. Any use of the insights, including sharing or interpretation, partly or wholly, requires explicit written permission.

Original Concepts

”Reverse Integration” is a concept/expression of Abishur Prakash/The Geopolitical Business, Inc.

”Geopolitical Density” is a concept/expression of Abishur Prakash/The Geopolitical Business, Inc.

”Geopolitical Reset” is a concept/expression of Abishur Prakash/The Geopolitical Business, Inc.